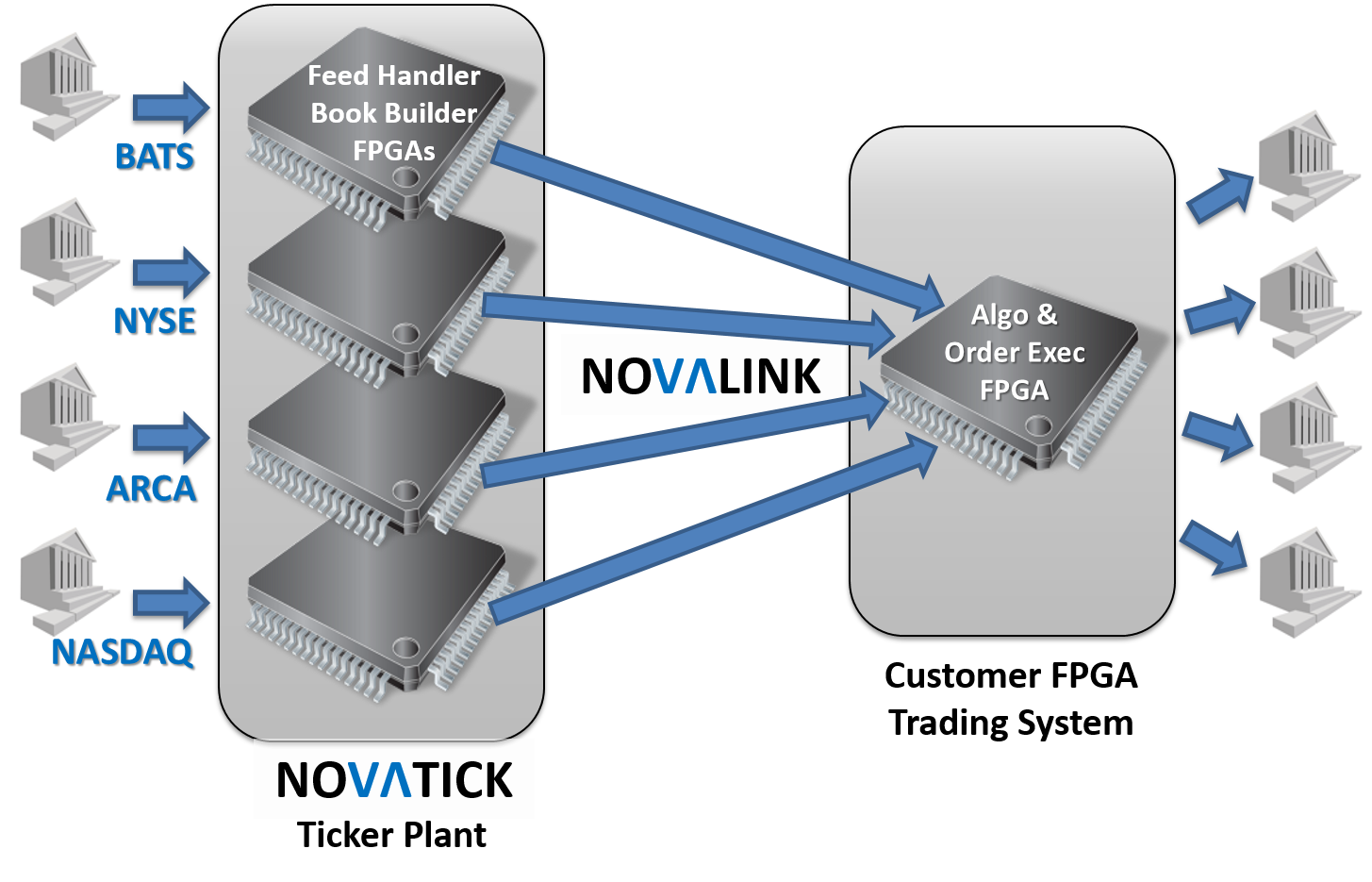

NovaLink is NovaSparks’ response to banks and trading firms who want to develop scalable trading systems on FPGAs.

NovaLink enables banks and trading firms to leverage NovaSparks’ extensive catalog of feed-handlers. This in turns allows the trading firms to concentrate their FPGA team resources on the development of their trading strategies and order execution components, resulting in significant reduction of the overall cost of development and time to market.

By using NovaLink, trading firms can now implement advanced strategies covering thousands of instruments across markets and asset classes that would not fit on a single chip design.

NovaLink extends the data processing pipe of NovaTick inside the customer trading FPGA Logic. To use a software analogy, NovaLink offers a normalized “hardware based API” IP core common to all the feeds. Like any normalized software API, once the integration is done for one feed, it is done for all the feeds. NovaLink sends the feed updates (book, status, trade, auction…) coming from the markets to the trading FPGA Logic.

External NovaLink interfaces with both Altera’s and Xilinx’s FPGAs and is available in several different options. Average latency with External NovaLink is around 700ns, measured from the wire on the market side to the trading firm’s FPGA.

Internal NovaLink comes with the NovaTick PCIe Card form factor and is designed to allow the trading logic to reside in the same FPGA than the feed handlers. This results in a better latency, from 50ns to 400ns depending on the publication levels used through the hardware based API.

NovaLink complements the existing 10Gig Ethernet Multicast and PCIe DMA distribution options already available in NovaTick.

Key Advantages

Accelerate time to market

Market Data feed handling represents a significant part of the work in developing a full FPGA tick-to-trade system. By integrating NovaLink in their full FPGA trading systems, trading firms have immediate access to NovaSparks extensive feed-handler catalog.

In addition, because the Ticker Plant has been off-loaded to a separate chip (or separate chips), the changes to the code of the strategy can be implemented and recompiled faster, independently from the market data processing component of the system, hence speeding up the development cycle and accelerating the overall time to market for a pure FPGA trading solution.

Support implementation of advanced trading strategies

Because the Ticker Plant is off-loaded to a separate FPGA (or several separate FPGA in the case of a multi-feed system), more resources (logic gates, memories…) are freed on the trading FPGA to implement complex strategies that otherwise would never fit on a single FPGA. This includes strategies that can cover thousands of instruments across multiple feeds and asset classes.

Contain development cost

FPGA developers are known to be expensive and scarce resources. By leveraging NovaSparks solutions, customers can relieve their FPGA development team from the task of developing and supporting multiple market data feed handlers.

Customers do not have to worry about allocating precious resources to handle new faster feeds for a market or to manage the flow of protocol changes that exchanges are constantly implementing. These types of changes are all managed by NovaSparks as part of the service.

Increase reliability

NovaSparks pure FPGA Ticker Plants come with several critical reliability features typically found only in software solutions. These include support for exchange refresh and/or packet retransmission services, advanced arbiter, snapshot… Trading firms do not need to choose between speed and reliability anymore, even when deploying full FPGA trading system.