Energize US Equity Trading with NovaTick™

A Comprehensive Solution

US equity markets are generating some of the most challenging data feeds to process for a ticker plant. They are also the most competitive trading markets in the world where using the right trading platform makes the difference between being ahead or far behind.

NovaTick solution for US equities is not only fast, but it is comprehensive. NovaTick support all 15 US equity protected markets (NASDAQ, BX, PSX, BZX, BYX, EDGX, EGDA, NYSE, ARCA, NYSE MKT, NYSE NAT, NYSE Chicago, IEX, MIAX and MEMX) as well as both SIP feeds from UTP and CTA. It also comes with a level of reliability and a complete set of features, that are required for your trading applications:

- Reliability:

- A/B Arbitration

- Wireless/Fiber Arbitration

- Exchange recovery and re-transmission service

- Snapshot service for late joining consumers

- Scale

- Support for the full instrument universe

- Consolidation of multiple markets with support of UBBO

- Filtering by Instrument ID and message Type

- Ease of integration

- Single 2U appliance

- Advanced Normalized C++ API, Messages or Hardware Bus

- Auto configuration

- Full appliance visibility for easy monitoring

- PTP time stamping

- Reference data API

- Richness of outputs

- Top of book data (L1)

- Top N of book data (L2)

- Full depth data (L3)

- Round/Odd/Full Lots

- ETF Basket Updates

- Snapshot

- Cut-Through Message Publication

- Conflated low bandwidth output for microwave

Deployment Options

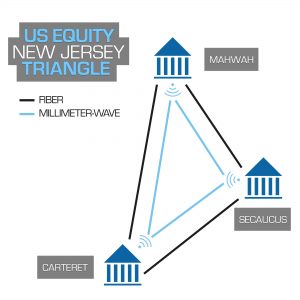

The main US equity data centers are located in Carteret, Secaucus and Mahwah. These three data centers are linked with both fiber and wireless networks offered by many providers.

NovaTick can be deployed following two use models:

- Decentralized:

One NovaTick appliance per data center processing the feeds locally. For example, the Carteret appliance processes NASDAQ BX and PSX feeds. - Centralized:

One NovaTick appliance is processing all the feeds in a single data center. For example, an appliance in Secaucus processes the 4 local feeds from CBOE as well as the remote feeds from NASDAQ and NYSE.